Cash Balance Plan and DB

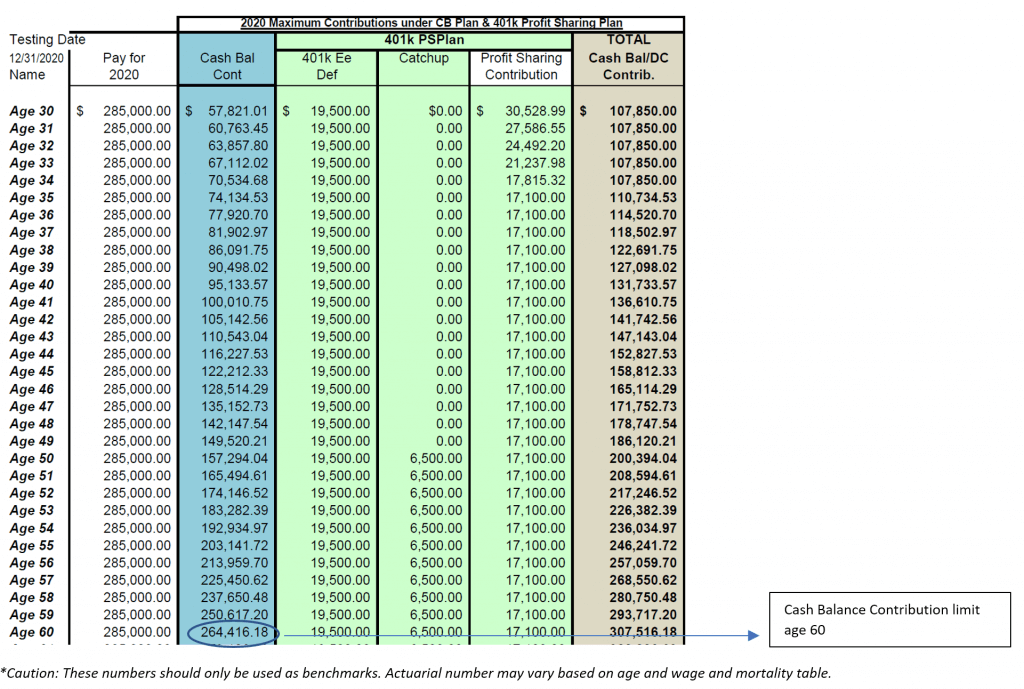

Cash Benefit plan save substantial amount of taxes. If you only have a 401k Plan, or profit-sharing plan, you may not be getting the maximum allowable contribution. For example, in 401k PS plan, the maximum you can contribute is $60,000 (Age over 60) vs in a Cash Balance Plan, you can contribute as high as $ $264,000 (chart below).

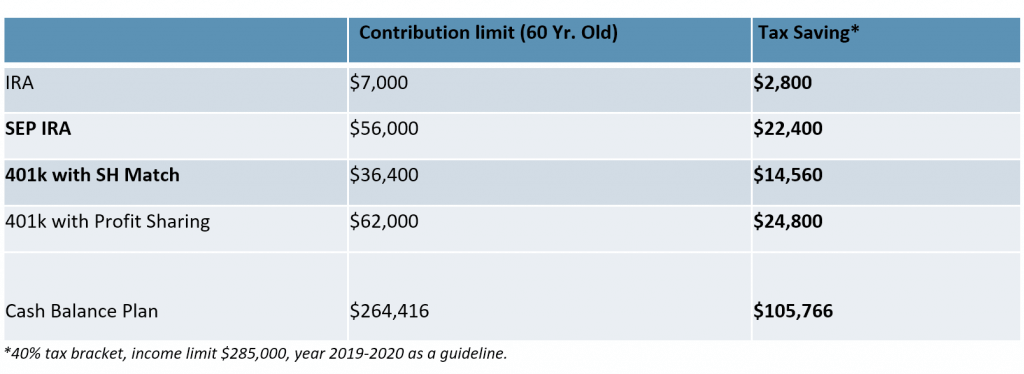

If you are in a 40% tax bracket, you will be letting go $105,600 tax savings if you contribute only to a 401k PS plan.

You can use the following sheet as a calculation for different types of account and potential tax savings:

A cash balance plan is a type of qualified plan, meaning it is tax deferred just as a 401(k) plan is, in which each participant has their own account. The account grows in two ways, first by the actual contribution and then second by a guaranteed interest credit, rather than a credit dependent on plan performance. The cash balance plan can be added to a 401(k) plan, similarly to the way a profit sharing plan can be added. This addition allows for a larger contribution amount and may be ideal for owners and partners looking for an accelerated method of retirement saving

A cash balance plan is a type of qualified plan, meaning it is tax deferred just as a 401(k) plan is, in which each participant has their own account. The account grows in two ways, first by the actual contribution and then second by a guaranteed interest credit, rather than a credit dependent on plan performance. The cash balance plan can be added to a 401(k) plan, similarly to the way a profit sharing plan can be added. This addition allows for a larger contribution amount and may be ideal for owners and partners looking for an accelerated method of retirement saving

The cash balance plan contribution is made by the employer; combining a 401(k) plan to this allows for employee contributions as well, which is why there can be a greater total annual contribution than with a cash balance plan or 401(k) plan on its own. The employer contribution is either a flat dollar amount or a percentage of an employee’s salary, as set forth in the plan documentation and decided by the employer. This amount is set and cannot change unless the entire plan changes contribution levels, unlike the flexibility found in a profit sharing plan, though employers may pay different contribution amounts for different employee levels. There are rules determining how often these changes can be made unless there is a valid economic reason. The interest credit, independent of plan performance, has a guaranteed rate of return, which changes annually but tends to be in the range 5%, similar to that of 30-year Treasury bonds. Should an employee leave the company, they may take whatever funds are vested.

Looking over the best use of a cash balance plan, it can be seen as most beneficial for several groups of people. First off, because the cash balance plan has set contribution amounts, the plan best suits a company with a steady and consistent profit and cash flow. Also, since a cash balance plan often has a 5% to 7.5% of pay contribution amount set to benefit partners and owners seeking to maximize savings, it is advisable for a company to already be paying around 3-4%, or to be willing to pay that amount, as all employees will benefit from the contribution percentage. As the higher maximums allow an accelerated savings, particularly as these accelerations are also age-based, a cash based plan will benefit older partners and owners looking to catch up on those savings.

Contribution limits in cash balance plan are age-based, with the older a participant is the higher the amount, as an older participant has fewer years to reach the $2.6 million lump sum amount that is allowed for the plan. This amount is subject to IRS limits and will be calculated via a formula in the plan documents.

As with other qualified plans, there are great tax benefits for an employer, as they reduce taxable income owing to their tax-deferred status with the IRS. This applies not only to the contributions themselves, but also to the earnings on those amounts.

Everyone’s situation is unique, but it is important to speak to a fiduciary financial advisor who can help you determine which retirement plan is suitable for you.