Coronavirus Market Volatility: A message from the Senior Partners, Aadil Zaman and Syed Nishat.

It seems like an understatement to say that this is an unprecedented time resulting from the novel coronavirus. The importance of the human factor of these events cannot be ignored, but there are also questions facing investors about how they should be handling the financial market. There’s no denying that those questions can be an added anxiety to everything else that’s going on. In times like this, a good financial advisor can be considered an ally who can act as a guide when emotions run high. Today’s emphasis in financial circles can tend toward the value of robo-advisors, but people may forget that when it comes to catastrophic events, robo-advisors are not equipped to handle investor concerns, as they cannot speak directly to investors and provide guidance for personal questions, nor can they counsel investors through these unusual market movements. The decisions an investor makes at times like these are vital to the health of their accounts and their planned financial goals. Here are 4 golden rules for investors to follow:

Remain Invested

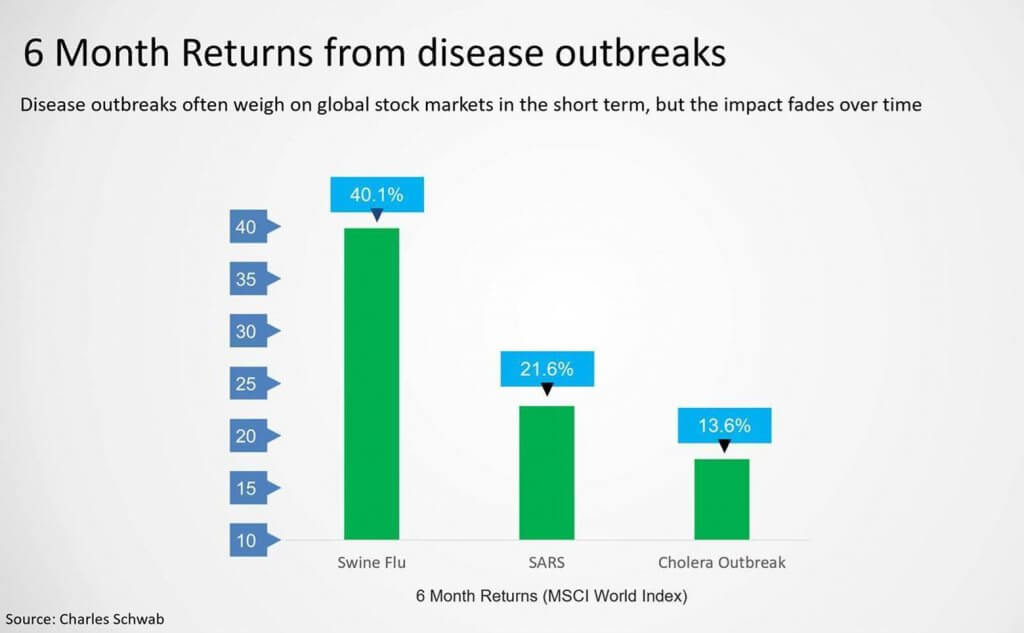

It comes as no surprise that the current situation resulting from the coronavirus creates a great deal of uncertainty. It is impossible to look at the swings in the market and predict how long this situation will last and when the market will turn around and move toward a recovery. However, some things can be learned from looking at historically similar events, such as the SARS outbreak, and one of the things that can be observed is that while there is a definitive short term effect, the long term has shown a market that has recovered and more. Looking at these situations in terms of probability, there is a higher than 75% chance that one year from now the market will be higher than it is currently. In the even longer term, the probability of the market being higher than its current position in ten years is nearly 100%. Taking this into account, a long term investor should not be in a rush to pull out of the market; declines such as this are a time to remain invested or even a time to be seen as an opportunity for buying.

Market Timing Doesn’t Work

One factor to take into consideration with this current market situation is that this is an event-driven sell off, a direct reaction to the increase of uncertainty brought up by the novel coronavirus’ impact on the world’s economies. This differs from previous declines in that there is nothing systemically wrong with the market– it is reacting purely to this current event. In 2008 for example, there were problems with the market, which was due for a correction before recovery could proceed. An event-driven sell off is more dependent on the specific event. In this case, when there is a resolution, whether due to the approval of a vaccine, the lessening of the spread because of weather changes, etc., the return of control will lead to the beginning of market recovery. Another difference that can be observed with this current event is not that the market has gone down, but the speed at which it has gone down. When the tech bubble burst in 2001-2002, it took time for the market to go down, and then years for it to go back up. This was observed again in 2008. This time, the same decline is happening in a matter of weeks. One of the reasons for this speed is the evolution of technology and machine trading; the movement that used to take years is now happening in weeks and months. While the negative impact of this is the quick reaction as the market slides, it also means that when the event is resolved, there’s a possibility that the market can rise quickly as well.

What does this mean to an investor? If a person is not invested, they will miss out on that speedy recovery. Looking from a historic point of view over the course of 20 years, the average return is 8.6% a year. If an investor is out of the market for the best ten trading days of those 20 years, the return would drop to only 2.5% a year*. The best days can come at times like the ones right now, and if an investor is not in, they will not benefit.

Stay Diversified

Of course, the human urge of panicking to sell off and then try to time a re-entrance into the market will crop up at this time, but this is not a good method of preserving an account. Jumping in and out of the market is never a sound investing tool because it is impossible to time those exits and entrances perfectly. The ways an investor can be hurt in times like these are the result of selling at the wrong time and not being diversified properly. In the case of selling with the incorrect timing, an investor will lock in their losses and then generally attempt to re-enter the market at the right time, which is impossible to predict, leaving them further behind. The question of diversification seems like an often-repeated admonition, but at times like this it becomes crucial. An overconcentration in one sector or stock leaves an investor vulnerable in the event that area falls. Again returning to the market decline of 2008, there were many people who had invested everything in financials; when the market inevitably recovered, those people never recovered their money.

The emotional reaction cannot be denied; of course it’s very difficult to see those sliding numbers and not feel some panic. However, the best course of action is to control the panic urge. In this case, working closely with a financial advisor is paramount, they will help you not only resist the siren call of selling off but also ensure that you are properly diversified. These are essential tools in managing a sell-off situation and protecting yourself.

Buy During Chaos

Another thing that can stoke a reaction is the discussion around this decline that states that this time it’s very different, a bigger problem that the market has never dealt with before. However, it pays to remain mindful of the fact that every time there is a market decline, it is something different every time. These drops tend to be unexpected. The oil crisis, the tech bubble burst– each time, there were unique circumstances. If it was the same reason over and over, the market perhaps wouldn’t fall because people would know what to do to prevent and stabilize it. Leaning into the line of thinking that a different situation will be an obstacle that can’t be overcome can bring a temptation to over-analyze and intellectualize the situation rather than to follow the same simple principles that define conscientious investing: diversification, remaining in line with the objectives of your investments, and staying the long course.

For some investors, a situation like this is a golden opportunity and can be seen as the best time to buy. Successful, high net worth people often use a time like this to invest while many others panic; they do not allow that reactive emotion to control their investing, but see where they can find the best choices of investments. Blue chip company investments may be available at a 20-30% reduction of their usual cost, pricing that is only found in market declines. As stated before, an investor cannot control an investment time perfectly nor get out at the perfect top. There are strategies needed to get the best prices. When investing in a market condition like this, the reality is that small businesses are extremely vulnerable. Because of their size, they cannot sustain declines the way a larger, established company can. Behemoths in every industry will have a short term decline, but they will bounce back sooner because they have the experience and resources to sustain themselves. When the market recovers, it is these companies that will get the larger market share when the small companies are no longer around. So for an investor creating a shopping list, it is often advisable to stick with high quality, diversified investments in these companies.

Looking forward, with the information available now, it can be quite easy to feel that with the coronavirus situation getting worse and no immediate improvement to the situation, that there is no way the market will improve soon. It’s important to differentiate the economy, the market, and the health situation; they are three different things and not inextricably correlated in their actions and reactions. The stock market is always forward looking, so it could very well recover earlier than the health situation or the economy. Right now, businesses are very clearly being affected by the uncertainty, but when the situation is under control, businesses will recover. It’s overly simplistic to imagine that the health situation and economy and stock market will all act together. It is more likely that they will move forward at different times, with the market potentially improving much sooner than the other two. To place themselves in the best place to mitigate loss and benefit from that recovery, it is important for investors to work closely with a financial advisor who will examine their personal concerns and position them to protect themselves while also looking forward to meeting their financial goals, even when difficulties arise.

*Source: https://www.cnbc.com/2019/01/03/tony-robbins-5-money-mistakes-investors-need-to-avoid-in-2019.html

The opinions and forecasts expressed are those of the author and may not actually come to pass. This information is subject to change at any time, based on market and other conditions and should not be construed as a recommendation of any specific security or investment plan. Past performance does not guarantee future results.