Article: Cash Balance Plan by Syed Nishat

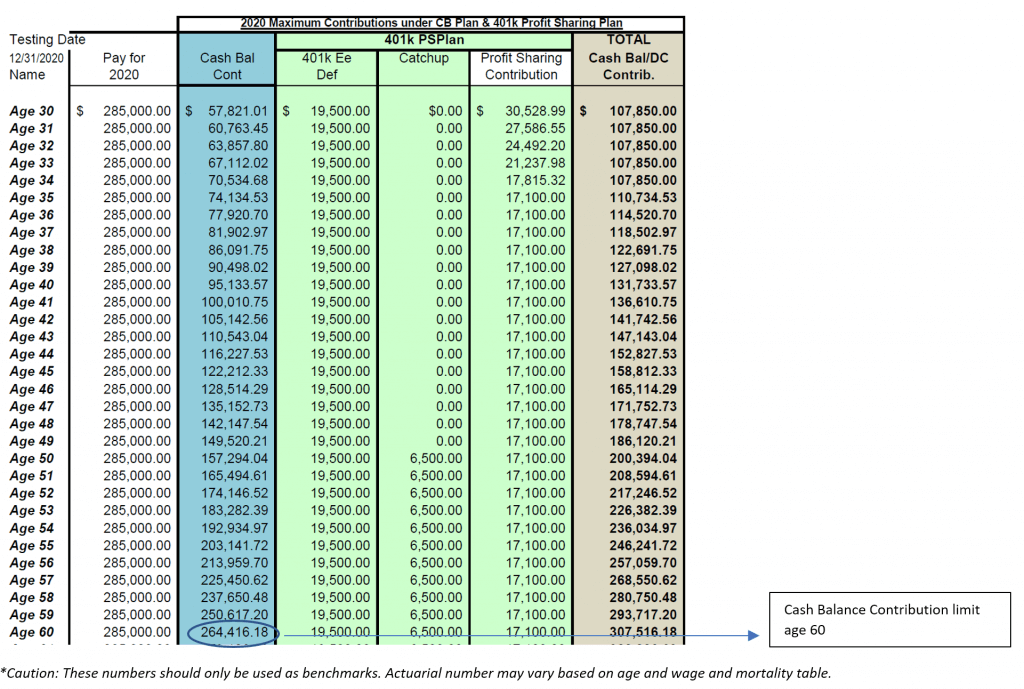

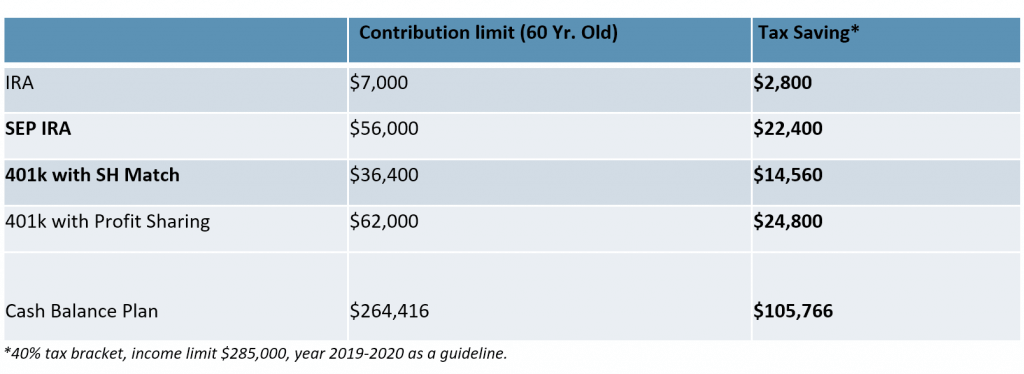

Cash Benefit plan save substantial amount of taxes. If you only have a 401k Plan, or profit-sharing plan, you may not be getting the maximum allowable contribution. For example, in 401k PS plan, the maximum you can contribute is $60,000 (Age over 60) vs in a Cash Balance Plan, you can contribute as high as $ $264,000 (chart below).

If you are in a 40% tax bracket, you will be letting go $105,600 tax savings if you contribute only to a 401k PS plan.

You can use the following sheet as a calculation for different types of account and potential tax savings:

Contribution limits in cash balance plan are age-based, with the older a participant is the higher the amount, as an older participant has fewer years to reach the $2.6 million lump sum amount that is allowed for the plan. This amount is subject to IRS limits and will be calculated via a formula in the plan documents.

Everyone’s situation is unique, but it is important to speak to a fiduciary financial advisor who can help you determine which retirement plan is suitable for you.

Please check out my latest article and interview about Cash Balance Plan in Medical Economics and Plansponsor.