Year End Charitable Tax Planning – By Syed Nishat

Year End Charitable Tax Planning by Syed Nishat

While establishing an estate plan, looking out for your beneficiaries may not be the only thing on your mind. As a member of your community, with your own special interests, you may be wondering how you can best maximize your charitable giving while also earning year-end tax benefits, a win-win for your asset strategy and estate planning. With these goals in mind, setting up a charitable trust may be your best option for maintaining your philanthropic focus, either during or after your life.

So, what is a Charitable Trust?

A charitable trust is an irrevocable charitable gift vehicle set up to donate a portion or all the assets in the trust to a charitable organization, with certain tax benefits attached. There are several types of charitable trusts, and it may be important for you to take the time to understand each to find which suits your personal situation in terms of chosen assets, donations, and benefits.

What are the different kinds of Charitable Trusts?

The best- known types of charitable trusts are the Charitable Remainder Trust (CRT) and the Charitable Lead Trust (CLT).

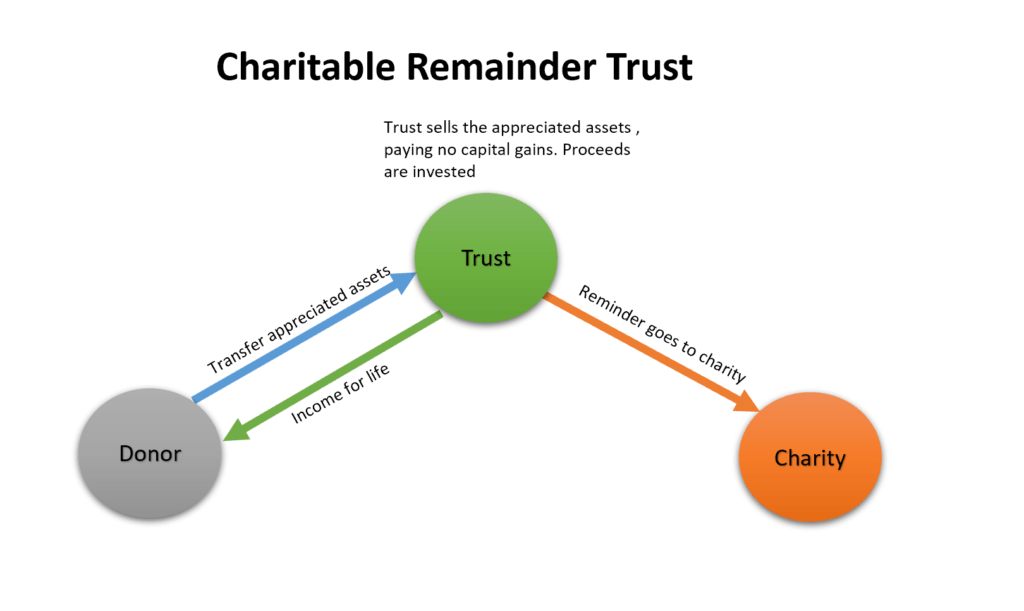

Charitable Remainder Trust:

In a Charitable Remainder Trust (CRT), the donor places assets into the trust, often those that are highly appreciated; during the donor’s lifetime, they continue to receive income from those assets as either annuity or percentage payments. This delineation is between the charitable remainder annuity trust (CRAT) which distributes a fixed annuity each year as opposed to the charitable remainder uni-trust (CRUT), which distributes a fixed annual percentage based on the balance of the trust assets. While CRATs don’t allow for additional contributions, CRUTs do permit them.

When the trust ends, the ownership of the assets which funded it pass to the charitable organization named when the trust was established. The largest attraction of this type of trust overall are the tax incentives, including lowered estate and capital gains taxes.

Charitable Lead Trust:

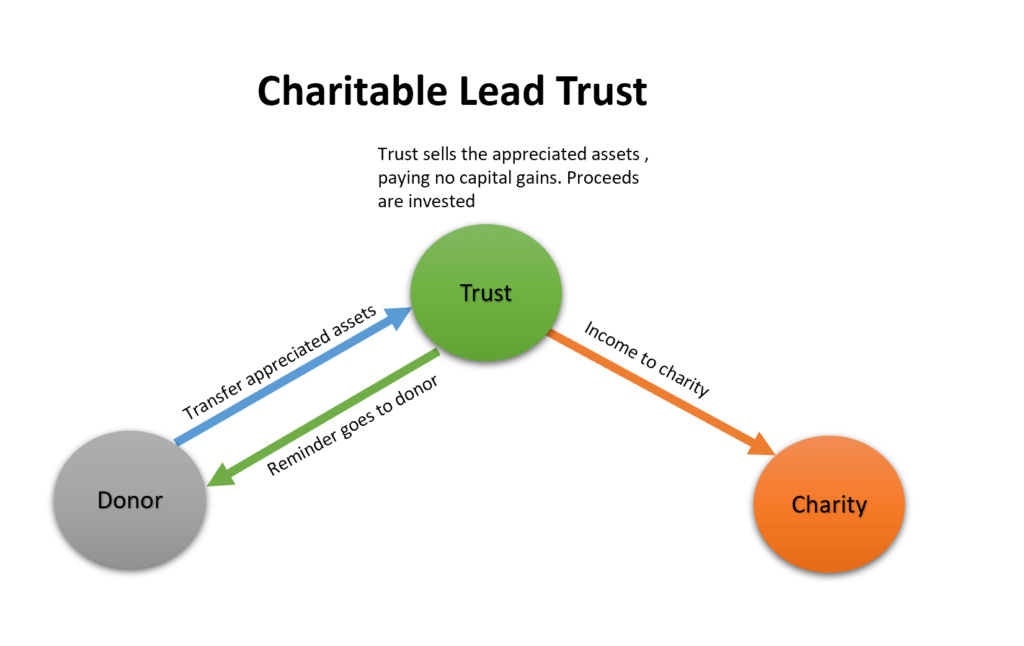

The Charitable Lead Trust is nearly the opposite of the CRT in operation, where the grantor donates assets into and then makes gifts out of the trust, providing a reliable source of income for one or more charities named in the trust, for a set amount of time. After this period expires, the remaining balance in the trust goes to the beneficiaries.

At that time, the leftover assets remain tax-free, and they don’t qualify for the rates of annual gift exclusions. However, unless you are the owner and donor of the trust, you cannot write off donations to the trust from your taxes. If you are both, you qualify for a single deduction to use the year the CLT is created.

Private Foundation:

For the most control and flexibility of the assets donated into a charitable vehicle where there has been a large amount of wealth accumulated early, a Private Foundation may be a good choice. Private Foundations are also set up to continue longer than other trusts, without the need for a set term or ending with the death of the donor. A foundation can be used to offer scholarships, grants, international grants and donations, as well as direct charitable programs, with benefits including double capital gains tax benefits, sheltered income, and expanded philanthropic opportunities. However, the amount of opportunity and flexibility is balanced by the ongoing legal and accounting fees, regulatory oversight, and lower deductibility. However, for a long-term legacy, the disadvantages may be outweighed by the ongoing programs you can set up.

Pooled Income Trust:

A Pooled Income Trust allows a donor to leave behind an estate that has a lower net worth than it had initially. This type of trust has a “pool” of several donors and donations to make a single large trust for named charities. The funds are not paid out to the charity until after the donor is deceased. These charities invest the money and pay out to the donors accord to the amount each contributed to the creation of the trust. This pooled income fund will allow you to ensure a perpetual income for necessary bills after retirement, claim an immediate income tax deduction when the pool is created, limit federal estate taxes while avoiding probate on the remainder of the estate, and make a future gift to charity. However, most pooled income trusts will only accept only liquid assets, meaning they will accept cash, stocks, and mutual funds while excluding assets like real estate, restricted securities, life insurance, or fine art and collectibles. If these are the types of assets you are looking to add to a pool of this type, there are limited options.

Donor Advised Fund (DAF):

As an alternative to a charitable trust, there is also a donor-advised fund (DAF), which is generally considered to be a less expensive option that is easier to donate to than traditional charitable trusts. A sponsor organization creates the fund with the purpose of investing assets and making donations. Any individual can donate assets to the DAF that they would donate to a charitable trust, and these donations are irrevocable, as they would be with a charitable trust as well. Upon donation, the donor receives the maximum tax deduction at the time of the donation, and they do avoid the extensive legal fees and setup costs that would be part of a charitable giving vehicle like a private foundation. However, there are still administration costs associated with DAFs that are passed on to the donor. Also, while the donor can make a request as to how the fund uses their donation, the DAF is not required to honor the request. While they do often choose grants and charities the donor would approve of, they have no obligation to do so.

Deadline and Final thoughts:

A donor can deduct up to 60% of Adjusted Gross Income if cash or 30% of Adjusted Gross Income if appreciated assets like stocks in a charitable trust. However, the donor can carry over the deduction for up to five additional years if it cannot be written off in a given year. The deadline to contribute cash or other property is before the close of the tax year.

Having a philanthropic aspect to your estate planning is way to continue your legacy with goodwill toward your community, and it can also benefit you and your family. Because of the different advantages and regulations, it is best to find the specific charitable giving vehicle that fits your own unique situation. Given the complexities of these trusts, it can be an enormous benefit to sit down and talk to an experienced financial advisor who will walk you through each option in the light of your own circumstances.

Schedule a complementary consultation!

“Securities America and its representatives do not provide tax or legal advice; therefore it is important to coordinate with your tax or legal advisor regarding your specific situation.”